Provision Language

Definitions

“Net Sales” means the invoiced price of a Licensed Product sold at arm’s length, or where the sale is not at arm’s length, the price that would have been invoiced if the sale had been at arm’s length, after deducting, to the extent not already deducted from the gross amount invoiced or otherwise charged, reasonable and bona fide:

- normal trade discounts, returns, expiries, rejects, destroyed stock and credits actually given; and

- the costs of carriage, insurance, freight and packaging if invoiced separately to the customer; and

- VAT, import duties and sales taxes actually paid by Commercialisation Partners; and

- Free samples for promotional purposes with quantities in accordance with usual practices.

7. Royalties

MPP will require that the Commercialisation Partners will pay royalties over Net Sales of Licensed Products directly to University on a country–by–country basis starting from the date of the first commercial sale of Licensed Products in the Territory. Royalties will be paid as described below:

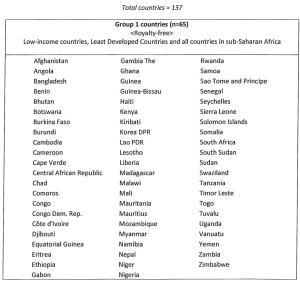

(i) Royalty-free where the supply of licensed products is to any Group 1 country for use solely in that country; and

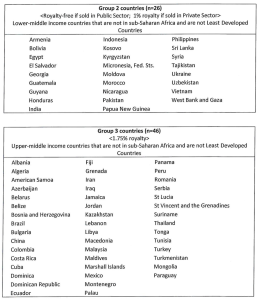

(ii) Royalty-free where the supply of licensed products is to Group 2 countries and for use solely in that country and where the licensed products are sold to the public sector in that country; and

(iii) In Group 2 countries where there is a valid issued licensed patent in the country of manufacture or sale, a royalty equal to 1% of the net sales value of licensed products where the licensed products are sold in the private sector; and

(iv) In Group 3 countries where there is a valid issued licensed patent in the country of manufacture or sale, a royalty equal to 1.75% of the Net Sales value of licensed product.

(v) Notwithstanding the above, no royalties will be owed on specific formulations labeled for the prevention and treatment of pediatric HIV (including the prevention of mother–to–child transmission).

Schedule 3 – The Territories

Schedule 5 – Commercialisation Agreement Term Sheet

4. Royalties: Commercialisation Partners will pay royalties over Net Sales within the Territory in accordance with Clause 7 of the MPP-University Agreement and the following terms. Any amounts due to the University shall be paid within 30 days of the end of each calendar year in respect to the amount of royalties generated during that year. All amounts so due will be paid in pounds sterling, by bank transfer to the account nominated by the University, which may be amended from time to time.

a. For the purpose of calculating royalties, a Licensed Product will be regarded as sold, leased or licensed when invoiced or, if not invoiced, when shipped or delivered by or a Licensee.

b. Royalties on Combination Products: If a Licensed Product is not priced separately to a Combination Product, the price of such Licensed Product for the purpose of calculating Net Sales shall be deemed to be the fair market value of the Licensed Product in the country of sale when sold separately. If Licensed Product is sold in combination with other products, the value of the Net Sales of such combination product shall be determined as follows:

Net Sales= A+(A+B)

A is the combined fair market value of all Approved ARVs / Additional ARVs in a Licensed Product,

B is fair market value of the other active pharmaceutical components included in the Licensed Product

c. For the avoidance of doubt sales comm1ss1ons, costs of collection and disputed amounts are not deductible. If Commercialisation Partner determines the resale price for subsequent transfers of Licensed Product, then Net Sales will be calculated based on the resale invoiced amount. Net Sales accrue at the first of delivery or invoice.

d. All amounts payable to the University under the Commercialisation Agreement are exclusive of tax or duties which Commercialisation Partner will pay at the rate from time to time prescribed by law.

e. All payments to the University should made using the reference “MPP_[Name of Licensee]” to the bank account noted on the invoice.

f. Royalties shall be calculated using Net Sales and there shall be no royalty stacking provisions applicable to any calculation of the royalties payable to the University.

In the event that there are only pending Licensed Patent(s) not yet granted in the country of manufacture or sale, Commercialization Partner will set aside the royalty amounts for sales of Licensed Products made under the Commercialisation Agreement during the pendency of the Licensed Patent(s), to be payable to the University only upon the issuance of a valid Licensed Patent.

If a Commercialisation Partner receives non-monetary consideration for any Licensed Products, Net Sales are calculated based on the fair market value of that consideration based on the sale of the Licensed Product to an independent third party during the same Royalty Period. Net Sales shall not include any transfers of supplies of the applicable Licensed Product for use in clinical trials, pre-clinical studies or other research or development activities.